All customers of the collapsed micro finance, savings and loans companies will effective Wednesday, September 16, 2020 receive cash instead of the earlier promised government backed bonds.

This follows the decision to convert all the government backed non interest bearing commercial paper (bonds) into cash at no discount in respect of the payments to affected depositors of the collapsed companies.

It will be recalled that the government had provided a combination of cash and bonds to pay depositors of the collapsed financial institutions, being 347 microfinance and 23 savings and loans companies.

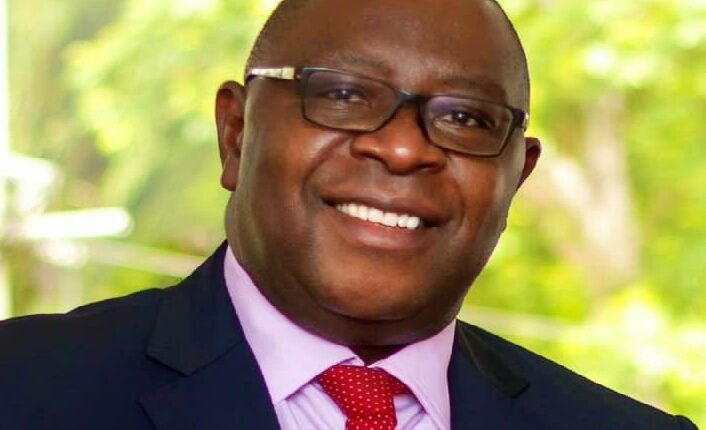

The Receiver, Eric Nana Nipah made the new arrangement of cash payment to all customers known in a press statement issued Tuesday .

The payment takes effect Wednesday, September 16, 2020 and will be paid by the Consolidated Bank of Ghana (CBG).

The new arrangement affects only depositors of the 347 microfinance companies and 23 savings and loans whose claims have been validated in the resolution process.

Mr Eric Nana Nipah explained that the decision had become necessary due to concerns raised by affected depositors in relation to the bonds.

He added that the new arrangement would also provide additional liquidity to the financial sector.

The Receiver added that government has made available to the Receiver/Official Liquidator additional GH¢3.56 billion, equivalent to the total value of the Bond component of funding required to fully satisfy the indebtedness of the resolved entities to their body depositors.

Consequently, depositors who have either received or are due Commercial Paper in partial satisfaction of their claims will now receive CASH payments at no discount for the Commercial Paper they have either received or is due to them, the statement explained.

In line with the government’s commitment to protect depositors funds and to shore up public confidence in the financial system, the Bank of Ghana shut down 347 microfinance companies, 23 savings and loans and 39 micro-credit companies by revoking their licenses.

The BoG then appointed Mr. Eric Nana Nipah as Receiver for the specified institutions in line with section 123 (2) of Act 930.

The depositors of the defunct companies were notified of the government’s decision to convert deposits into government backed non interest bearing commercial paper (Bonds).

The government made available to the Receiver of the above resolved companies, as well as the Official Liquidator of the Micro Credit Companies in official liquidation, a combination of cash and Commercial Paper totaling approximately GH¢6.49 billion to fully settle the valid depositor claims on these institutions.

As the Receiver/Official Liquidator brings the processing and payment of valid depositor claims to closure, a total amount of approximately GH¢6.07 billion has been paid to some depositors of these resolved companies, leaving an amount of approximately GH¢402 million to be paid to the remaining depositors, to fully settle all valid depositor claims in the resolution process.

Of the total amount of approximately GH¢6.49 billion required to fully settle all valid depositor claims in the resolution process, about GH¢3.56 billion of these claims in value representing approx 55% of total claims payable are being settled with government of Ghana backed Non-Interest bearing Commercial Paper (Bond), with the remaining approximately 45% in value of claims payable, worth approximately GH¢2.93 billion being settled with cash.

It is the bond that has now been converted into cash.